What is Accounting Software Implementation: Step-by-Step Process

What is Accounting Software Implementation

Accounting software implementation is the process of introducing and integrating new accounting software into an organization’s existing systems and workflows. It involves a series of planned steps to ensure a smooth transition from old systems to the new software. This process typically includes assessing the organization’s needs, selecting the appropriate software solution, configuring the software to meet specific requirements, migrating data from previous systems, training users, testing the software’s functionality, and deploying it across the organization.

The goal of accounting software implementation is to enhance the efficiency, accuracy, and effectiveness of financial management processes within the organization. It aims to streamline tasks such as bookkeeping, invoicing, budgeting, reporting, and compliance by leveraging the capabilities of modern accounting software.

For Whom Accounting Software is Needed:

Small Businesses: Accounting software is essential for small businesses to manage their finances efficiently, track expenses, invoice clients, and generate financial reports without the need for extensive manual processes.

Medium to Large Enterprises: Medium and large enterprises benefit from accounting software’s scalability, advanced features, and integration capabilities, allowing for the management of complex financial operations across multiple departments and locations.

Freelancers and Self-Employed Individuals: Freelancers, consultants, and self-employed individuals use accounting software to track income and expenses, invoice clients, and manage taxes, enabling them to maintain financial control and professionalism.

Who Doesn’t Need Accounting Software?

Very Small Businesses with Simple Finances: Some very small businesses with straightforward financial transactions and minimal reporting requirements may find that basic spreadsheets or manual methods suffice for their accounting needs.

Individuals with Minimal Financial Activity: Individuals with minimal financial activity, such as hobbyists or retirees, may not require accounting software if they can manage their finances effectively with simple budgeting tools or manual methods.

Organizations with Specialized Requirements: In some cases, organizations with highly specialized accounting requirements or unique business models may find that generic accounting software solutions do not fully meet their needs, and they may opt for customized or industry-specific software instead.

Common Issues with Implementing a new Accounting System

Implementing a new accounting system can encounter various challenges, but with proactive planning and strategies, these hurdles can be overcome effectively. Here are some common issues to be aware of:

Lack of Clarity: Without a clear understanding of objectives, it’s challenging to gauge success. Hence, comprehensive planning is vital to establish clear goals and expectations.

Lack of Authority: It’s crucial that the designated project lead possesses the necessary knowledge and authority to steer the implementation process effectively.

Scope Creep: Trying to accomplish too much too quickly can lead to scope creep. It’s essential to start with achievable goals, celebrate milestones, and gradually introduce new features in manageable phases.

Distractions: Running a business involves various activities that can divert attention from the implementation process. Planning the implementation during periods of relative calm can help mitigate distractions.

Time Constraints: Adequate time should be allocated for the complete and accurate implementation of the new system. Additionally, sufficient time for staff training is essential to ensure users can fully leverage the system’s benefits.

While implementing a new accounting system may seem daunting, with meticulous planning and the right support, it’s entirely feasible. We’re equipped with the expertise, knowledge, and resources to guide you through each stage of the process.

Take your time to plan your new accounting system implementation

Planning your new accounting system implementation is crucial for success, as it lays the groundwork for smooth execution. Allocating ample time for system requirements ensures a robust foundation. Here are some key steps to focus your planning and set the stage for success:

Designate a “Project Lead” who possesses a deep understanding of the business and its processes. This individual should have the authority to lead the team and garner support for the transition.

Conduct thorough pre-sale research and due diligence to ensure alignment between your technical requirements and the chosen product.

Identify and involve key stakeholders early in the process, including departmental process owners, to secure buy-in and collaboration. Effective communication with teams beyond finance, such as purchasing and sales, is essential for a holistic approach.

Collaborate with consultants responsible for onboarding. Whether managing the implementation internally or through trusted partners, consultants will define critical elements such as the Chart of Accounts and user profiles during the design phase, streamlining the subsequent build process.

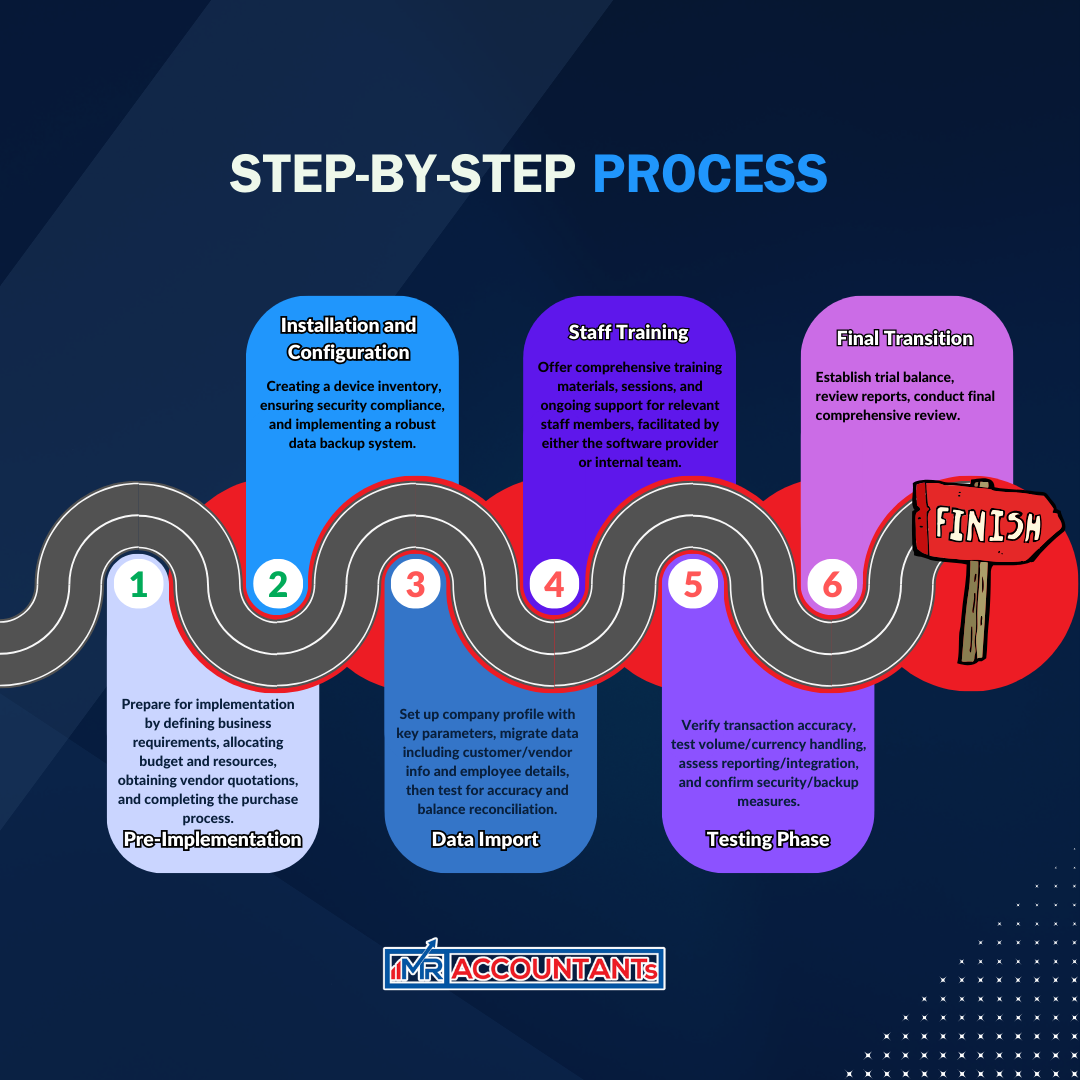

Step-by-Step Process:

To ensure a smooth transition and maximize the benefits of the new system, a well-thought-out implementation plan is essential. Here’s a step-by-step guide to help you navigate through the process seamlessly.

1. Pre-Implementation Preparation:

Define Business Requirements: Identify functions and features required tailored to your business line and management needs.

Budget Allocation: Allocate funds for accounting software, training, contingency, and any additional expenses.

Resource Allocation: Determine resources required, such as IT department personnel, accounting department employees, etc.

Vendor Quotation: Request quotations from vendors, evaluate them based on price, discounts, warranty policies, and other relevant details, and negotiate for the best deal.

Purchase: Proceed with the purchase once the vendor has been selected.

2. Installation and Configuration:

Device Inventory: Make a comprehensive list of devices requiring software installation, specifying department, designation, user ID, and device type.

Security Measures: Ensure installation and backup systems adhere to the company’s data security and privacy policies.

Data Backup: Implement a robust data backup system to safeguard against potential losses.

3. Data Import:

Company Setup: Create a new company profile, setting parameters such as company name, tax code, and accounting policy.

Data Migration: Import crucial data including customer/vendor information, employee details, tax rates, and posting entries.

Testing: Verify the accuracy of data import and reconcile opening balances to ensure a seamless transition.

4. Staff Training:

Training Resources: Provide comprehensive training materials, sessions, and ongoing support for relevant staff members, either by the software provider or internal team.

5. Testing Phase:

Transaction Accuracy: Verify that all transactions are recorded accurately and the system correctly calculates account balances.

Volume and Currency Testing: Test the system’s capacity to handle high transaction volumes and transactions in different currencies.

Reporting and Integration: Assess reporting capabilities and integration with other systems, ensuring smooth operation across platforms.

Security and Backup Testing: Verify the system’s security measures and backup procedures to mitigate risks.

6. Final Transition:

Trial Balance: Set up a trial balance to confirm the accurate transfer of accounts to the new software.

Report Verification: Review all reports to ensure accuracy and completeness.

Final Review: Conduct a comprehensive review to ensure adherence to the implementation plan and address any remaining issues.

By following these steps diligently, businesses can streamline the implementation of new accounting software, enhancing efficiency, accuracy, and overall productivity in financial management processes.

Choosing the Right Partner for Accounting Software Implementation

In the realm of accounting software implementation, selecting the right company is crucial for success. Companies that excel in this area often have extensive experience, provide tailored solutions, offer comprehensive training, and emphasize transparent processes.

At Mr-Accountants, we take pride in being a trusted partner for accounting software implementation. Our transparent and effective process ensures quality results in daily transactions. We prioritize skill enhancement through up-to-date training for you and your team, fostering a well-organized and high-performing work environment. Trust us for a seamless transition, promoting accountability and efficiency in your business. Business Screening Link: https://form.asana.com/?k=P4r_V16RKk9crqcGeHc0vA&d=1201888507136963 or you can directly hire us on upwork: https://www.upwork.com/agencies/1445126036106850304/