We can work on any of the accounting software and add-ons of your choice!

We prefer to have a short call to get the understanding of your business.

Where we try to answer the following questions –

- What are your products or services?

- Your revenue model

- Your cost nature

- Your internal processes (Where needed)

Also, induction to the contact person or with the team we will be working

Firstly we will need access to your System.

MR-Accountants Part –

-Will create a shared folder and share with the client

Client Part –

-As per the checklist and based on the work scope will share the documents

Must Need – Bank and Card Statement for Each month. (Where possible view access of the Banks to reduce client work burden)

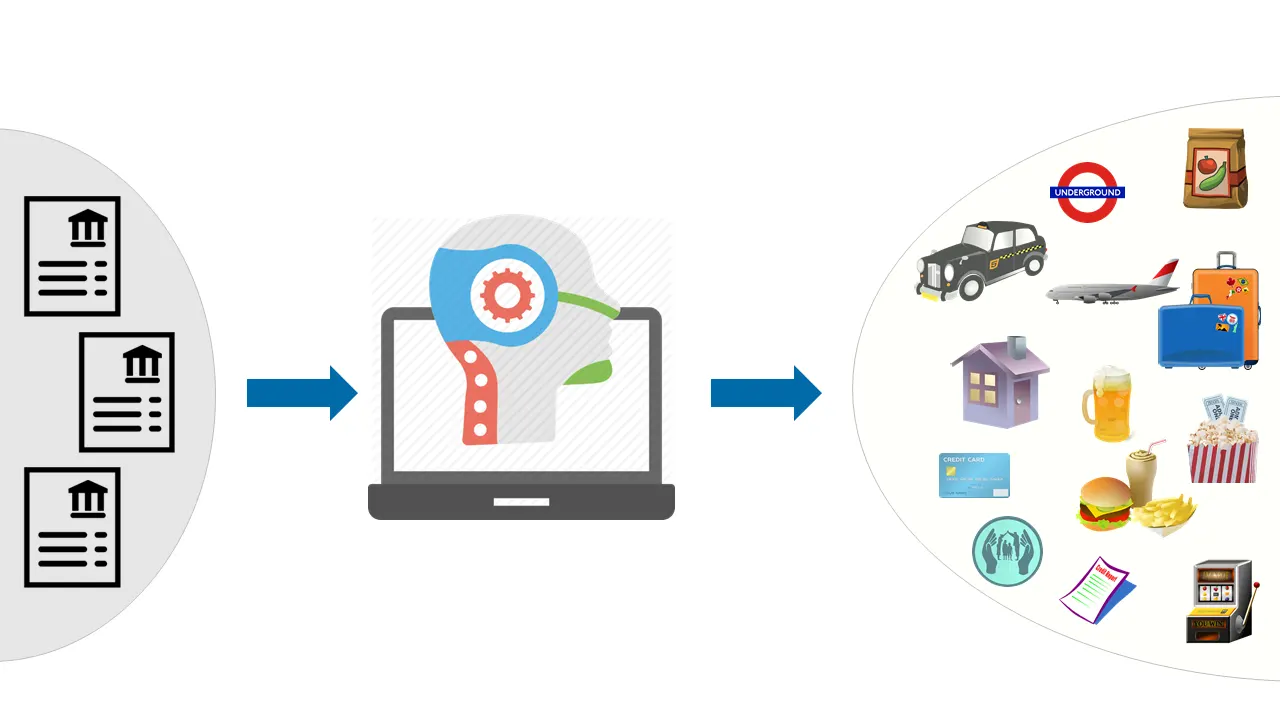

MR-Accountants part –

- Will categorize the transactions to the correct chart of accounts

- Will match the Payment against the invoice or bills

- Create a query file where need clarification from the Client (Which will be in the shared folder)

Client part –

-Will check the query file and add the comments to clarify (For complex transactions we might have a call)

Once Transactions are categorized we perform Reconciliation for all the Balance sheet accounts. Which includes –

- Bank

- Loan

- Receivables

- Payables

- Any other Asset or liability account as needed

As needed by client we Provide different reports. Some major reports are mentioned here –

-Management report (PL, BS, CF)

-Customer aging report

-Revenue Summery

-Profitability analysis etc.

We support Local Accountant or CPA when they need us.

Tax – We help prepare return from System or by providing the required data with them

Audit – We try to document all the evidence within the system. Which always help when audit comes. (incase client fail to provide document it’s their responsibility to arrange the documents at the time of audit)

MR. ACCOUNTANTS ALL TIME RESERVED | DEVELOPED BY ANIRBAN SOFT