Unveiling the Power of Net Profit Margin

Introduction:

When it comes to measuring a company’s profitability and financial performance, few metrics hold as much significance as the net profit margin. As a fundamental ratio, net profit margin unveils the true earning potential of a business by revealing how efficiently it converts revenue into profit. According to a study conducted by McKinsey & Company, high-performing companies across industries tend to have consistently higher net profit margins than their peers. This highlights the correlation between profitability and overall business success. (Source: McKinsey & Company). In this blog post, we will explore the power of net profit margin as a key metric and shed light on its importance in assessing business success.

Understanding Net Profit Margin:

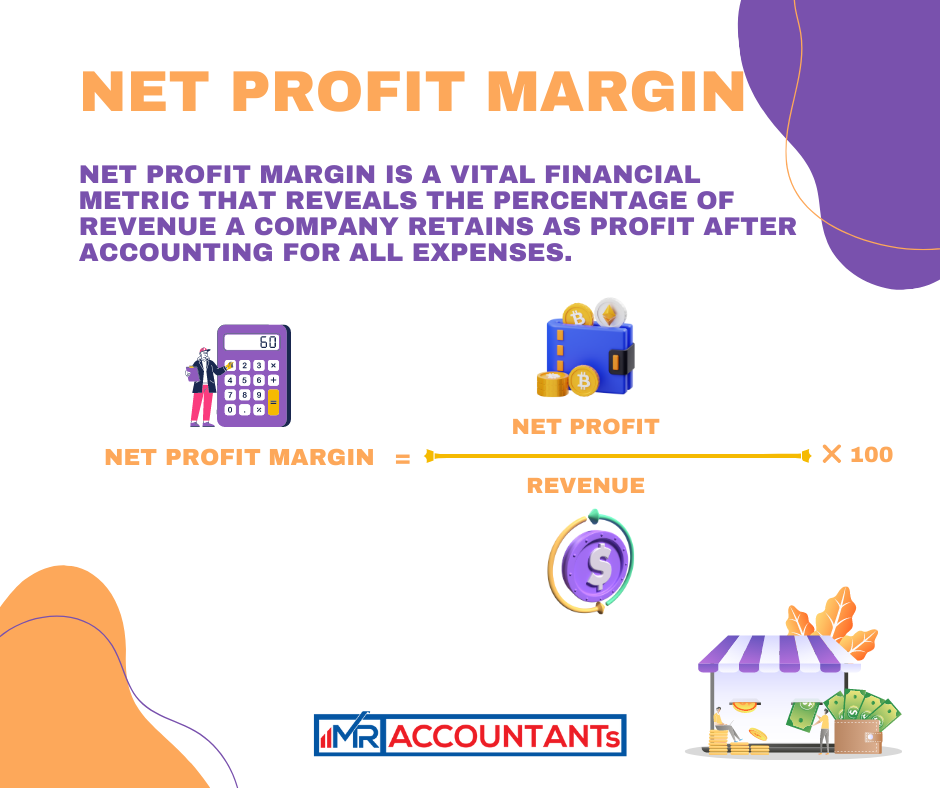

Net profit margin is a vital financial metric that reveals the percentage of revenue a company retains as profit after accounting for all expenses. It reflects a company’s ability to manage costs, generate revenue, and ultimately achieve sustainable profitability. By analyzing net profit margin, businesses can gain valuable insights into their financial health and make informed decisions regarding operations, pricing, and resource allocation.

Calculation of Net Profit Margin:

To calculate net profit margin, use the following formula:

Net Profit Margin = (Net Profit / Revenue) × 100

Here, “Net Profit” represents the profit remaining after deducting all expenses, including the cost of goods sold, operating expenses, taxes, interest, and other relevant expenditures. “Revenue” refers to the total income generated by the company from its primary business activities.

Key Significance of Net Profit Margin:

1. Profitability Assessment: Net profit margin serves as a crucial indicator of a company’s profitability and financial success. It enables businesses to evaluate their ability to generate profit and assess the effectiveness of their revenue generation and cost management strategies. A higher net profit margin implies better profitability and efficient operations.

2. Performance Comparison: Comparing net profit margins across different periods, business units, or industry benchmarks can provide valuable insights into a company’s performance. It helps identify trends, spot areas for improvement, and track the effectiveness of strategies implemented to enhance profitability.

3. Operational Efficiency: Net profit margin offers a lens into a company’s operational efficiency by revealing its ability to control costs and optimize revenue generation. A higher net profit margin suggests that a company is effectively managing its expenses and maximizing its profitability per unit of revenue.

4. Investor Confidence: Net profit margin is a key metric that investors, shareholders, and lenders consider when evaluating the financial health and potential returns of a company. A healthy net profit margin indicates stability, profitability, and an attractive investment opportunity. It can help build investor confidence and attract additional capital for growth and expansion.

5. Pricing and Cost Management: Net profit margin analysis provides insights into the pricing strategies and cost management practices of a company. By monitoring and adjusting pricing structures and cost controls, businesses can strive to achieve optimal net profit margins while ensuring competitiveness in the market.

Conclusion:

Research by Harvard Business School found that companies with higher net profit margins are better positioned to weather economic downturns and market uncertainties. These companies demonstrate stronger resilience and ability to sustain profitability even during challenging times. (Source: Harvard Business School). The net profit margin varies significantly across industries. For example, industries such as technology and software typically have higher net profit margins due to their scalability and lower production costs, while industries such as retail and hospitality tend to have lower margins due to higher operating expenses and thinner profit margins. (Source: Investopedia). Net profit margin stands as a powerful metric that enables businesses to assess their profitability, efficiency, and overall financial health. It plays a vital role in decision-making processes, investor confidence, and performance evaluation. By monitoring and analyzing net profit margin, companies can make informed decisions to enhance profitability, optimize operations, and pave the way for sustained success in a competitive business landscape.