Differences between Balance Sheets vs Profit and Loss Statements

In the complex world of finance, two crucial documents stand out as pillars for evaluating a company’s financial health: the Balance Sheet and the Profit and Loss Statement (also known as the Income Statement). While both serve distinct purposes, they work in tandem to provide a comprehensive view of a company’s financial standing. In this blog post, we’ll delve into the differences between these two financial statements and explore their individual roles in assessing a company’s performance.

Balance Sheet:

The Balance Sheet is a snapshot of a company’s financial position at a specific point in time. It reflects the company’s assets, liabilities, and equity. Think of the Balance Sheet as a financial snapshot that captures what a company owns (assets), owes (liabilities), and the residual interest belonging to the owners (equity).

a. Assets: Assets are anything of value that a company owns. They are classified into two categories – current assets (like cash, accounts receivable, and inventory) and non-current assets (such as property, plant, equipment, and long-term investments).

Current Assets: Current assets are resources expected to be converted into cash or utilized within a year or an operating cycle of the business. Examples encompass cash, accounts receivable, inventory, and prepaid expenses. These assets play a crucial role in day-to-day operations and aid in meeting short-term obligations.

Typically, current assets are arranged in the following sequence:

Cash and cash equivalents

Marketable securities: Tradable stocks, bonds, and other securities

Accounts receivable: Money owed by customers for goods and services

Inventory

Prepaid expenses: Payments made in advance for items like rent, salaries, utility expenses, and small business insurance.

Non-Current Assets: Non-current assets, also known as long-term assets or fixed assets, are anticipated to provide economic benefits to the business for more than a year. This category encompasses property, plant, equipment, intangible assets, investments, and long-term receivables. Non-current assets contribute to the company’s long-term growth and operational stability.

Non-current assets are typically organized in the following manner:

Long-term investments: Assets held by a business for over a year, such as stocks, bonds, mutual funds, cash, or real estate assets.

Fixed assets: Property or equipment owned by a company and used in day-to-day operations for income-generating activities. This includes machinery, equipment, buildings, and land.

Intangible assets: Non-physical assets like goodwill, copyrights, patents, intellectual property, and customer lists. Intangible assets are usually included in the balance sheet if they are acquired rather than developed internally.

b. Liabilities: Liabilities represent the company’s obligations or debts. Similar to assets, liabilities are categorized into current liabilities (short-term obligations like accounts payable and short-term debt) and non-current liabilities (long-term debts and deferred tax liabilities).

Current Liabilities: Current liabilities are responsibilities anticipated to be resolved within a year or an operational cycle. Examples encompass accounts payable, short-term loans, accrued expenses, and current portions of long-term debt. The settlement of current liabilities relies on the utilization of current assets.

Common current liabilities include:

1. Interest payable

2. Salaries payable

3. Accounts payable: Amounts owed by a business to its creditors

4. Dividends payable

5. Accrued expenses: Costs that have been incurred but remain unpaid

6. Income taxes owed

Non-Current Liabilities: Non-current liabilities are financial obligations or debts expected to be settled over a period longer than one year. This category includes long-term loans, bonds, deferred tax liabilities, and other extended obligations. Non-current liabilities signify the company’s prolonged financial commitments.

Examples of non-current liabilities include:

1. Long-term debt: Loans and liabilities with a maturity exceeding one year, such as bank loans, debentures, and mortgages

2. Capital leases

3. Bonds payable

4. Pension liabilities

5. Customer deposits

c. Equity: Equity is the residual interest in the assets of the company after deducting liabilities. It represents the owners’ claim on the company’s assets and is often referred to as shareholders’ equity.

Profit and Loss Statement (Income Statement):

The Profit and Loss Statement, on the other hand, provides a dynamic view of a company’s performance over a specific period, typically a quarter or a year. It details the revenue generated, expenses incurred, and ultimately, the net profit or loss.

a. Revenue: At the heart of the Profit and Loss Statement lies the concept of revenue, often interchangeably referred to as sales. This financial metric encapsulates the entire sum a company garners through its primary operations. It serves as a critical indicator of the organization’s ability to generate income, providing a fundamental measure of its economic activity.

b. Expenses: Delving into the expenditure side, the Profit and Loss Statement meticulously outlines the various costs incurred by a company in the process of revenue generation. These expenses are typically categorized into two main groups: operating expenses and non-operating expenses. Operating expenses encompass day-to-day costs integral to sustaining regular business operations, such as rent, utilities, and wages. On the other hand, non-operating expenses encompass items like interest payments and taxes, which, while not directly tied to daily operations, still impact the company’s overall financial health.

c. Net Profit or Loss: The culmination of the Profit and Loss Statement is marked by the net profit or loss, often referred to as the bottom line. This crucial figure succinctly encapsulates the financial outcome of the company’s operations during the specified period. A positive net profit denotes that the company has generated more revenue than it incurred in expenses, signifying profitability. Conversely, a net loss indicates that expenses have surpassed revenue, warranting a closer examination of the company’s financial strategies and operational efficiency.

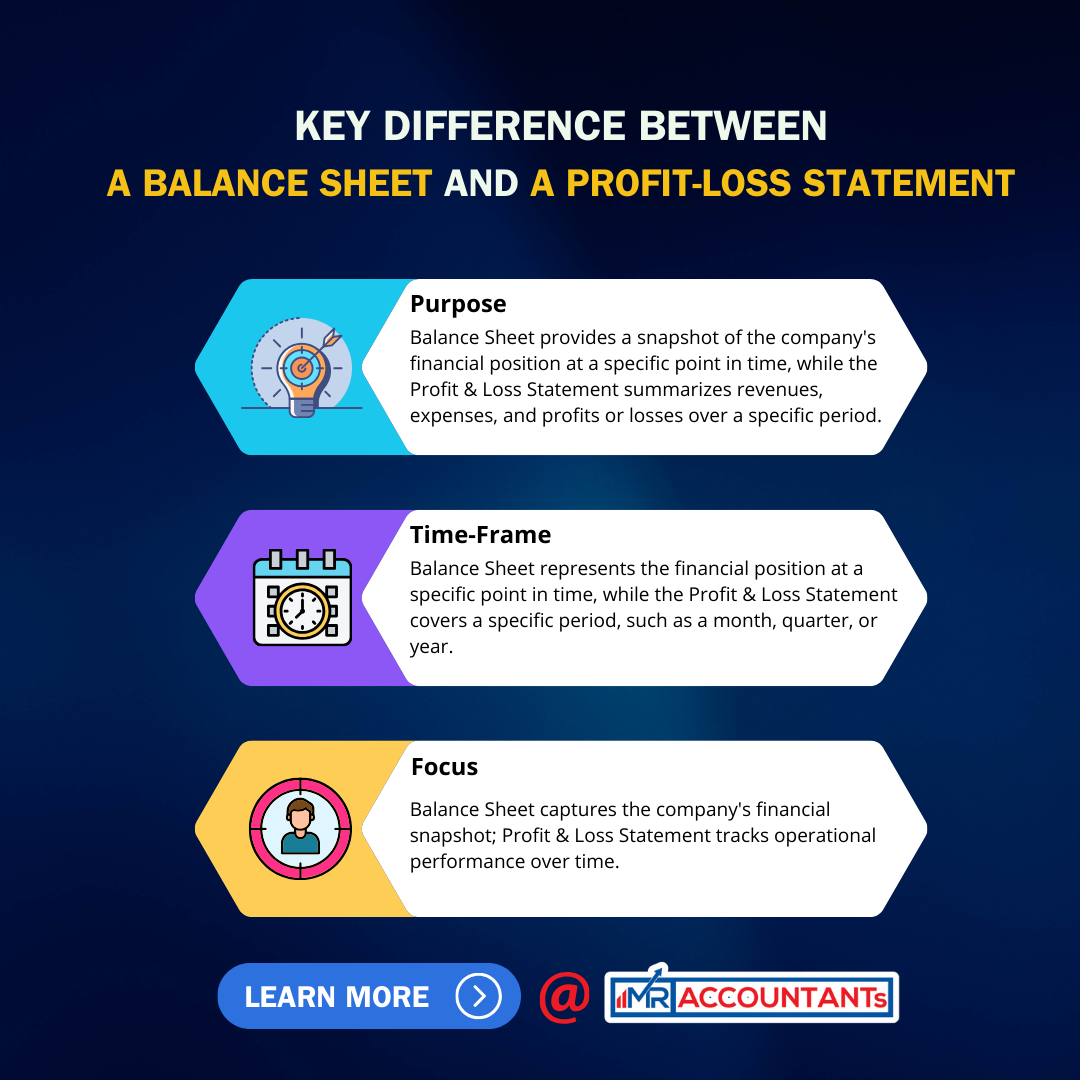

Key Difference Between a Balance Sheet and a Profit and Loss Statement

Purpose

Balance Sheet: Provides a snapshot of the company’s financial position at a specific point in time.

Profit and Loss Statement: Summarizes revenues, expenses, and profits or losses over a specific period (e.g., a month, quarter, or year).

Timeframe

Balance Sheet: Represents the financial position at a specific point in time.

Profit and Loss Statement: Covers a specific period (e.g., a month, quarter, or year).

Components

Balance Sheet: Consists of assets, liabilities, and equity.

Profit and Loss Statement: Consists of revenues, expenses, and net profit or net loss.

Focus

Balance Sheet: Focuses on the company’s financial position and resources at a given moment.

Profit and Loss Statement: Focuses on the company’s operational performance and financial results over a period.

Usage

Balance Sheet: Used for assessing the company’s financial health, liquidity, and capital structure.

Profit and Loss Statement: Used for evaluating the company’s profitability, operational efficiency, and revenue sources.

Calculation of Profits/Losses

Balance Sheet: Does not directly calculate profits or losses.

Profit and Loss Statement: Calculates net profit by deducting total expenses from total revenues.

Presentation

Balance Sheet: Presented in a ‘T’ format, showing assets on one side and liabilities & equity on the other.

Profit and Loss Statement: Presented in a linear format, starting with revenues, followed by expenses, and ending with net profit or net loss.

Frequency of Preparation

Balance Sheet: Prepared at the end of an accounting period (e.g., quarterly or annually).

Profit and Loss Statement: Prepared at the end of each accounting period to summarize the period’s financial activity.

Long-Term vs Short-Term Perspective

Balance Sheet: Provides insights into the company’s long-term financial health.

Profit and Loss Statement: Provides insights into the company’s short-term financial performance.

Examples of Items Included

Balance Sheet: Assets: cash, accounts receivable, equipment, etc. Liabilities: loans, accounts payable, etc. Equity: owner’s equity, retained earnings, etc.

Profit and Loss Statement: Revenues: sales, fees earned, etc. Expenses: cost of goods sold, salaries, rent, etc.

Connecting the Dots:

Understanding the relationship between the Balance Sheet and the Profit and Loss Statement is crucial. For instance, a company might report a healthy profit on its Income Statement, but a closer look at the Balance Sheet might reveal high levels of debt, raising concerns about its long-term sustainability.

The Balance Sheet and Profit and Loss Statement together offer a holistic perspective on a company’s financial standing, enabling investors, analysts, and stakeholders to make informed decisions. While the Balance Sheet provides insights into a company’s assets, liabilities, and equity, the Profit and Loss Statement sheds light on its operational performance.