Demystifying Gross Profit Margin: A Key Metric for Assessing Business Profitability

Introduction: In the realm of business, profitability is a vital factor that determines the success and sustainability of a company. One essential indicator used to evaluate profitability is the Gross Profit Margin (GPM). Understanding the significance of GPM and its implications for a business is crucial for entrepreneurs, investors, and stakeholders alike. In this blog post, we will delve into the intricacies of Gross Profit Margin, exploring its definition, calculation, and its role as a critical metric in assessing business profitability.

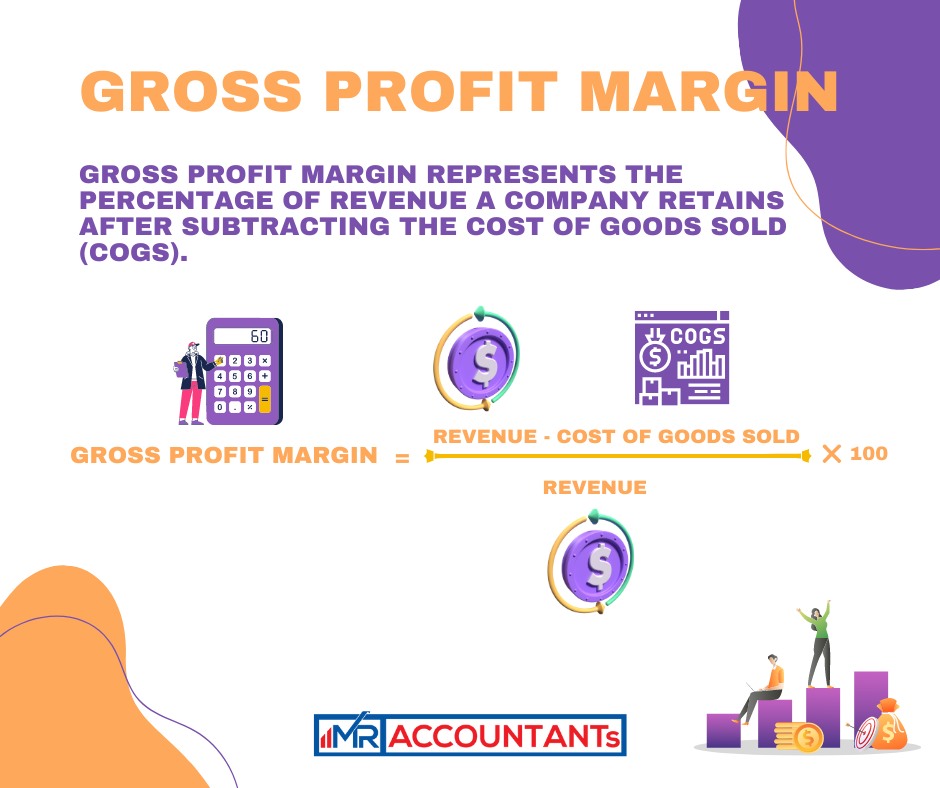

Defining Gross Profit Margin:

Gross Profit Margin represents the percentage of revenue a company retains after subtracting the cost of goods sold (COGS). It reflects the profitability of a company’s core operations and provides insights into its ability to generate revenue while covering the direct costs associated with producing or acquiring the products or services it sells. GPM serves as a key performance indicator, shedding light on a company’s efficiency in managing production costs and pricing strategies.

Calculating Gross Profit Margin:

To calculate Gross Profit Margin, we use a simple formula:

Gross Profit Margin = (Revenue – Cost of Goods Sold) / Revenue * 100

This formula expresses GPM as a percentage, allowing for easier comparisons across companies and industries. A higher Gross Profit Margin generally indicates that a company retains a larger portion of its revenue after accounting for production costs, suggesting stronger profitability.

Interpreting Gross Profit Margin:

Gross Profit Margin holds immense significance for businesses for several reasons:

1. Assessing Cost Efficiency: GPM provides insights into how efficiently a company manages its production costs. A higher GPM implies that a company can generate more revenue per unit of production cost, indicating effective cost management and potentially higher profitability.

2. Pricing Strategies: GPM helps businesses evaluate their pricing strategies. By considering the relationship between revenue and COGS, companies can determine if their pricing structure adequately covers their production costs and leaves room for profitability.

3. Comparative Analysis: GPM enables comparisons within an industry or across competitors. Examining GPM ratios can help identify companies with superior cost control and pricing strategies, giving valuable insights for benchmarking and decision-making.

4. Financial Health Indicator: GPM is an essential metric for assessing a company’s financial health. A consistent, healthy GPM indicates that a business is generating sufficient profits from its core operations, which contributes to long-term sustainability and growth.

Conclusion:

Gross Profit Margin serves as a vital metric for evaluating a company’s profitability and financial health. By examining the relationship between revenue and COGS, GPM provides insights into a company’s cost efficiency, pricing strategies, and overall operational performance. A higher GPM generally indicates stronger profitability and effective management of production costs.

For businesses, monitoring and improving Gross Profit Margin is crucial for sustainable growth and success. By analyzing GPM alongside other financial indicators, entrepreneurs, investors, and stakeholders can gain a comprehensive understanding of a company’s profitability and make informed decisions to drive future success.