Understanding Personal Income: Definition & Key Differences from Disposable Income

- Abid Hossain

- Sep 9, 2024

- 5 min read

Introduction:

Income is a fundamental aspect of personal finance, influencing everything from daily spending habits to long-term financial planning. However, the terminologies surrounding income can sometimes be confusing. Two terms often used interchangeably are "personal income" and "disposable income." While they are related, they have distinct meanings and implications. In this blog post, we'll delve into the definitions of personal income and disposable income, as well as highlight the key differences between them.

Personal Income:

Personal income refers to the total earnings received by individuals from all sources before taxes and other deductions. It encompasses various forms of income, including wages, salaries, bonuses, tips, rental income, dividends, interest, and other investments. Essentially, it represents the amount of money an individual earns within a specified period, typically on a monthly or annual basis.

Components of Personal Income:

1. Earned Income: This includes wages, salaries, commissions, and bonuses earned from employment.

2. Investment Income: This comprises dividends, interest, capital gains, and rental income generated from investments such as stocks, bonds, real estate, and mutual funds.

3. Government Transfers: It includes social security benefits, unemployment benefits, pensions, and other forms of government assistance.

4. Other Sources: Personal income may also include income from other sources like royalties, alimony, and gifts.

Calculating Personal Income:

To calculate personal income, one would sum up all sources of income received by an individual within a specific time frame, such as a month or a year. It serves as a measure of an individual's earning capacity and financial resources before any deductions.

Disposable Income:

Disposable income, on the other hand, refers to the amount of money individuals have available for spending and saving after taxes have been deducted. In other words, it is the income remaining after paying taxes to the government. Disposable income represents the actual funds individuals can allocate towards consumption, savings, investments, and debt repayment.

Components of Disposable Income:

1. Taxes: This includes federal, state, and local income taxes, as well as payroll taxes such as Social Security and Medicare taxes.

2. Mandatory Deductions: Certain mandatory deductions, such as contributions to retirement accounts like 401(k) plans or pension schemes, may also reduce disposable income.

3. Voluntary Deductions: Voluntary deductions like health insurance premiums and charitable contributions may further reduce disposable income.

Calculating Disposable Income:

Disposable income can be calculated by subtracting taxes and other mandatory deductions from personal income. It reflects an individual's actual purchasing power and discretionary income available for various financial activities.

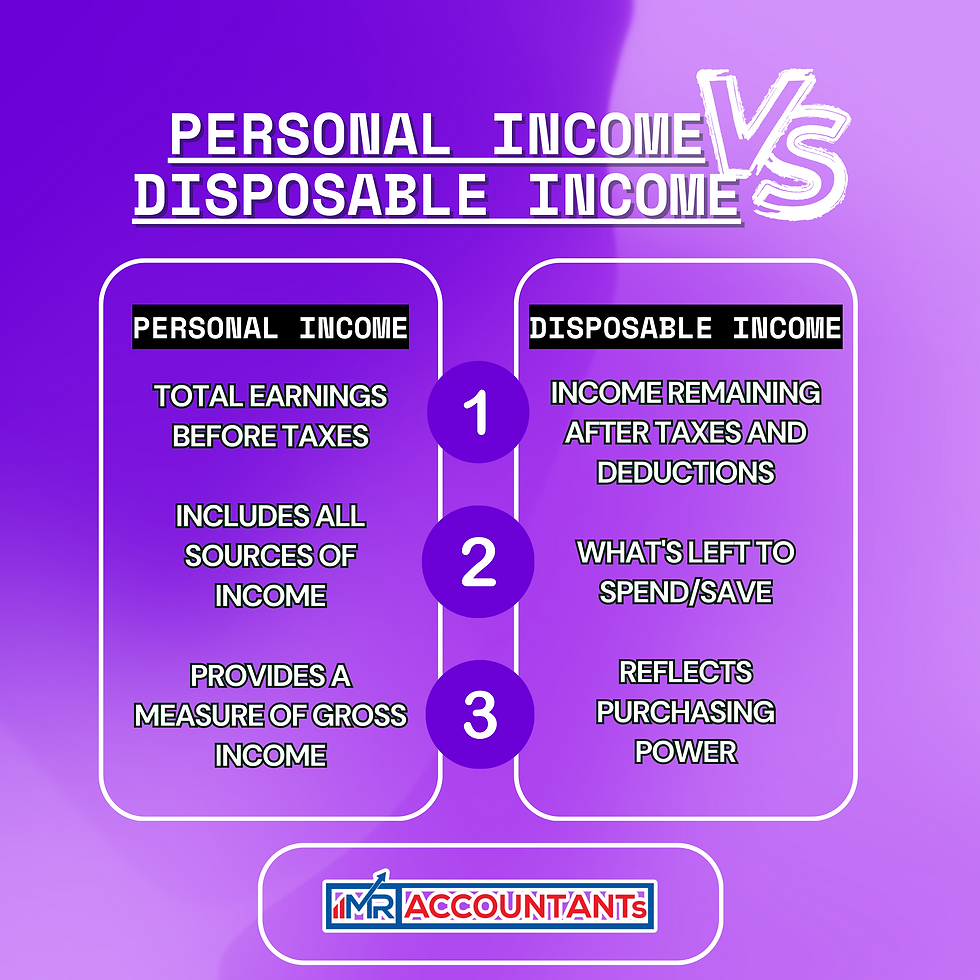

Key Differences:

Let's explore the differences between Personal Income and Disposable Personal Income:

Definition:

Personal Income: Personal income refers to the total earnings received by individuals from all sources before taxes and other deductions. It encompasses various forms of income, including wages, salaries, bonuses, dividends, interest, rental income, government transfers, and other sources of income.

Disposable Personal Income (DPI): Disposable Personal Income represents the amount of money individuals have available for spending and saving after taxes have been deducted from their personal income. In other words, it is the income remaining after tax payments to the government.

Focus:

Personal Income: Personal income focuses on measuring the total income earned by individuals from all sources, providing an overview of their earning capacity and financial resources before any deductions.

Disposable Personal Income: DPI focuses on the income available for consumption, savings, investments, and debt repayment after accounting for taxes. It reflects individuals' actual purchasing power and discretionary income.

Calculation:

Personal Income: Personal income is calculated by summing up all sources of income received by individuals, including wages, salaries, bonuses, dividends, interest, rental income, and government transfers, before any deductions are made.

Disposable Personal Income: DPI is calculated by subtracting taxes and other mandatory deductions, such as contributions to retirement accounts or healthcare premiums, from personal income. It represents the actual funds individuals can allocate towards consumption and savings.

Economic Indicators:

Personal Income: Personal income is an important economic indicator used to assess individuals' financial well-being, income inequality, and trends in personal earnings. It provides insights into the overall health of the economy and serves as a basis for measuring consumer spending and saving behaviors.

Disposable Personal Income: DPI is a crucial economic indicator for analyzing consumer purchasing power, consumption patterns, and discretionary spending. It is closely monitored by policymakers, economists, and analysts to gauge the impact of taxation on household finances and assess the effectiveness of fiscal policies.

Importance:

Personal Income: Personal income is essential for understanding individuals' income levels, assessing their ability to meet expenses, save for the future, and invest in assets. It serves as a basis for evaluating economic inequality and measuring the distribution of income within a society.

Disposable Personal Income: DPI is vital for measuring individuals' actual purchasing power and discretionary income available for various financial activities. It helps policymakers and businesses understand consumer behavior, forecast demand for goods and services, and make informed decisions regarding economic policies and marketing strategies.

Personal Income vs. Personal Consumption Expenditures

Personal Income and Personal Consumption Expenditures (PCE) are two important economic indicators that provide insights into the financial health and spending behavior of individuals within an economy. Let's explore the differences between these two concepts:

1. Definition:

- Personal Income: Personal income refers to the total amount of earnings received by individuals from all sources before taxes and other deductions. It encompasses wages, salaries, bonuses, dividends, interest, rental income, government transfers, and other forms of income.

- Personal Consumption Expenditures (PCE): PCE represents the total amount of money spent by individuals and households on goods and services within a specific period, typically on a monthly or annual basis. It includes spending on durable goods (such as cars and appliances), nondurable goods (such as food and clothing), and services (such as healthcare and transportation).

2. Focus:

- Personal Income: Personal income focuses on measuring the income earned by individuals, providing a comprehensive view of their earning capacity and financial resources.

- Personal Consumption Expenditures: PCE focuses on tracking consumer spending patterns, reflecting how individuals allocate their income towards consumption.

3. Relationship:

- Personal Income and PCE are closely related, as personal income serves as the primary source of funds for personal consumption expenditures. When individuals receive income, they have the option to either spend it on consumption, save it, or invest it.

- Changes in personal income can influence personal consumption expenditures. For example, an increase in income may lead to higher spending on goods and services, while a decrease in income may result in reduced spending.

4. Economic Indicators:

- Personal Income: Personal income is an important economic indicator used by policymakers, economists, and analysts to assess the overall health of the economy, measure income inequality, and track trends in personal earnings.

- Personal Consumption Expenditures: PCE is a key component of Gross Domestic Product (GDP) calculations and is widely used to gauge consumer confidence, economic growth, and inflationary pressures. Since consumer spending accounts for a significant portion of economic activity, PCE is closely monitored as an indicator of economic health.

5. Importance:

- Personal Income: Personal income is crucial for understanding individuals' financial well-being, assessing their purchasing power, and evaluating their ability to meet expenses, save for the future, and invest in assets.

- Personal Consumption Expenditures: PCE is vital for measuring the overall level of consumer spending, which drives economic growth and activity. Changes in consumer behavior, such as shifts in spending patterns or saving rates, can have significant implications for businesses, industries, and the broader economy.

Conclusion:

Understanding the distinction between personal income and disposable income is crucial for effective financial planning and budgeting. While personal income represents the total earnings received by individuals from all sources, disposable income reflects the amount available for spending and saving after taxes have been deducted. By grasping these concepts, individuals can better manage their finances, make informed decisions, and work towards achieving their financial goals.

.png)